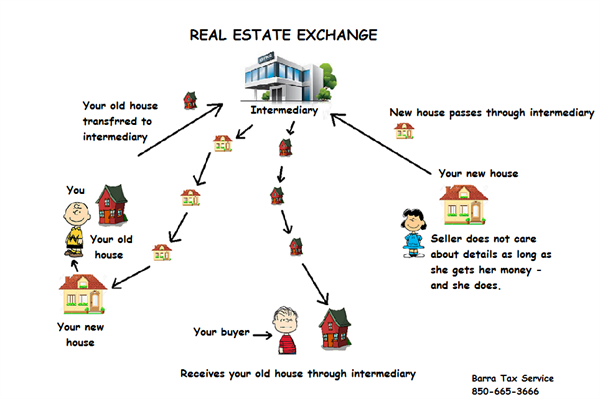

A real estate exchange is defined in the law as a "Section 1031" exchange. It is transferring one piece of real estate for another through a qualified intermediary. Why do we need a qualified intermediary and additional expense? Why not just sell and buy another? Simple - that would be far too easy and lots more people would do it and save taxes.

Most will exchange for a property of greater value, here there is not immediate tax. If the property acquired is of lesser value, then the difference is taxed. So if you exchange a parking lot for $250K for a rental house for $200K, the $50K you didn't spend will be taxed.

If you exchange the parking lot above for the same rental and acquire a rental condo as well for $100K, no tax. The new basis from the parking lot is split between the two new properties taken in exchange, and you will add the additional cost over the exchanged amount to it.

USE AN EXPERIENCED INTERMEDIARY

One of my clients used their own lawyer - DON'T EVEN CONSIDER IT!!

I was on the phone with my client's attorney for hours explaining how it worked and what he had to do, he billed them for his time talking to me, and his research beyond that. It cost my clients far more than it should have. There are experts who do this exclusively, (some even know more than I do) it costs about $1,500 or so for the exchange paperwork and proper deed transference.

SAD STORY

A client called me and said I would be proud of him. He said: "Chris, I exchanged the palace!" He sarcastically called it "The Palace" because he hated that three family house. He said he had "exchanged" it for a rental condo. I said: "Bill, what intermediary did you use?"

He said "What do you mean?"

I said: "Please don't tell me that".

He sold and then just bought the condo. Doing it this way cost him $75,000 in tax because he did it wrong. He was a good sport about it, laughed it off and just said: "I guess I just learned the hard way." I think it hurt me more than it did him. Don't learn the hard way - and never blame the messenger.

HAPPY TALE

Another client properly exchanged a long standing, fully depreciated 6 family apartment building and for two single family rentals. They used a qualified intermediary (Starker Services) and saved $106,000 in tax.

So - do it right.

There are three basic types of real estate exchanges:

Simultaneous - done the same day

Delayed - Sell and buy another property soon

Reverse - Buy new one and sell your property later

Each of these methods can be multiple exchanges.

Some of the specific rules we have to follow for this to work:

There are strict time limits that must be adhered to for an exchange to pass the muster of the tax police.

The timer starts ticking the day of the first closing.

For a simultaneous exchange, no problem - it is all done that day, no time issues. For the others there are 2 key limits:

45 Days

In a delayed exchange, your property is sold and you have 45 days from that closing date to identify a new property for purchase. You can identify as many as three, and select one (or all three) for exchange). You must inform the intermediary of your identified property selection(s).

180 Days

We are allowed 180 days to complete the deals. So we must close on the final property involved in the exchange within that time period.

TAX IS NOT FORGIVEN, IT IS DEFERRED

(MAYBE FOREVER IF YOU PLAY IT RIGHT)

Keep in mind that tax is not forgiven on this sale, it is delayed - could be deferred forever and never paid, but the basis of the original property is carried over to the new property. So if it is ever sold conventionally, you will be hammered because you have to use that old basis for your cost to calculate profit. BUT if an heir inherits the house, they will receive the "Stepped up" basis. If they inherit it and sell it the day after you die, no tax on the sale.

This is how big boys play.